Dealing With the Increasing Costs of College

Developing a college saving habit can provide your children with the funds they need and provide you with the satisfaction of knowing that you are doing the right thing.

The cost of sending a child to college is increasing and shows very few signs of slowing. The reasons for these increases are many. Many states have been forced to reduced their support for public universities, schools have spent to improve facilities, there has been increased demand as more high school graduates choose college over entering directly into the work force and some say colleges have lagged in improving their productivity with technology as other industries have done.

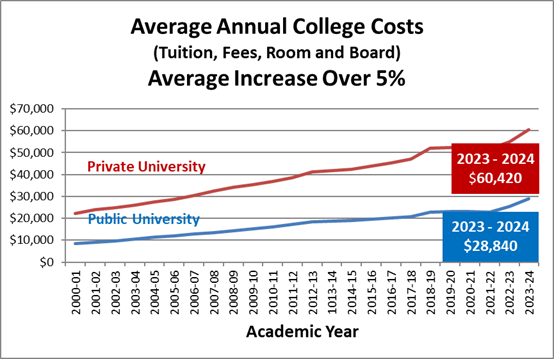

College Costs of Today

As the chart below shows, average costs have almost doubled over the past 16 years. You should also note that the costs reflected do not include additional costs like transportation, books and entertainment.

Estimate the College Costs of Tomorrow

For the past several years, college costs have been increasing at a rate faster than the overall inflation rate. While it is impossible to know what will happen in the future, here is a chart that demonstrates what happens at annual increases of 4%.

College |

Annual cost today |

Annual cost in 5 years |

Annual cost in 10 years |

Annual cost in 15 years |

Private |

$60,420 |

$73,500 |

$89,400 |

$108,800 |

Public, in-state tuition |

$28,840 |

$35,100 |

$42,700 |

$51,950 |

Public, out-of-state tuition |

$46,730 |

$56,850 |

$69,200 |

$84,150 |

And do not forget, these are just the annual costs; and if your child attends for four years, you must multiple by 4. And, do not forget to include additional costs of books, transportation and entertainment.

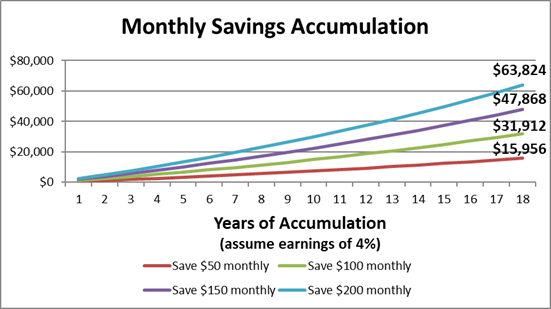

Starting to Save Early is Critical

As with saving for any goal, the sooner you start and the more you save, the more you will have when you need it.

Choose the Best Way to Save

Starting to save on a regular and consistent basis is most important. The next decision to consider is how to hold the funds.

As Part of Regular Savings

One option for parents is to just consider saving for a child’s college as part of their total savings program. This is simple, but doesn’t provide an easy way to identify how much progress is being made toward a goal. Establishing a separate account for college savings helps with monitoring progress. However, the earnings on the funds will be taxable to the parents.

Custodial Accounts

Another option is to establish a custodial account for the child. Using a Uniform Gifts to Minors Act (UGMA) or Uniform Transfer to Minor Act (UTMA) account is an easy and legal way to transfer the ownership of assets to a child. With a UGMA or UTMA account, the parent creates a custodial account on behalf of the minor child. Assets are transferred into the account and the custodian, usually a parent, manages the account until the child reaches legal age. At that point, the child can do whatever he or she wishes with the assets. Transfers to these accounts are irrevocable. Earnings on the account are taxable to the child which may save some income taxes.

Coverdell Education Savings Accounts

These accounts function like an IRA with earnings not being taxed if the funds are used for qualified education purposes. The largest drawback to Coverdell ESA’s are that annual contributions are limited to $2000. There are also income limitations for these accounts.

Section 529 College Savings Plans

These college savings plans are now offered by over 40 states and were also enhanced by the 2001 Tax Law. While the plans are offered by the state, there is no restriction on where the child attends college utilizing the funds. One potential drawback is that there are usually limited investment options. It makes sense to look at several states programs to find one that offers the investment choices you desire.

With a Section 529 Plan, there are no income limits on the donors and contributions of up to $15,000 ($30,000 for a couple making a joint gift) can be made in 2021. In addition, there are special provisions to allow a "front-end loading" of up to five years of contributions to be made without gift taxes. Withdrawals used for qualified educational purposes are excluded from federal income taxation.

Conclusion

Enabling a child to attend the college of their choice and get an education that will prepare them for a successful and productive life is one of the greatest gifts you can give. However, the costs of providing that college education can be very large. Starting earlier rather than later can make the process easier, especially with some of the tax benefits a Section 529 College Savings Plan.

Developing a college saving habit can provide your children with the funds they need and provide you with the satisfaction of knowing that you are doing the right thing.