How Does Inflation Impact Your Finances?

Why inflation is important and what you should do.

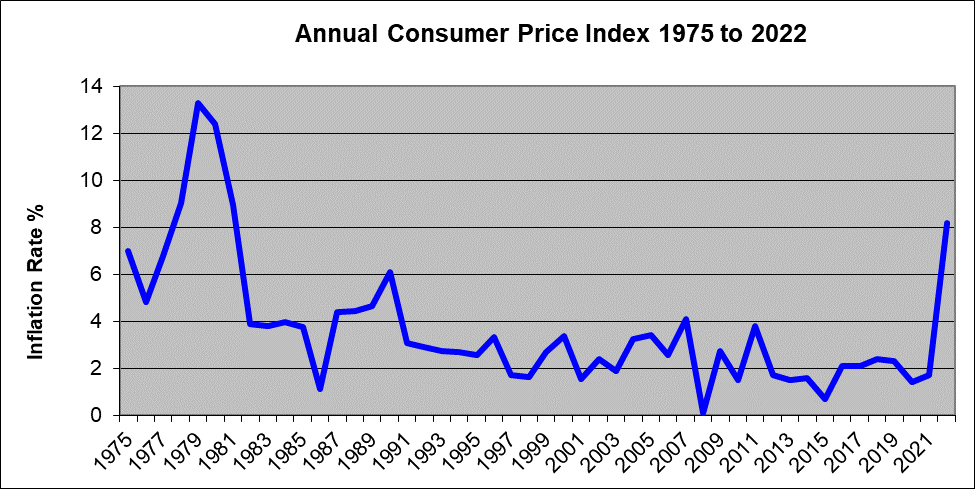

Until recently, inflation had been under control. The overall rate of inflation, as measured by the Consumer Price Index had been averaging less than 3% through 2020. For 2020, the rate of inflation was 1.4%. However, in 2021, inflation began to tick up, climbing to levels not seen since the 1980s. In September 2022, the inflation rate hit 8.2% fueled by sharply rising energy and food prices.

While the inflation rate has subsided in 2023, falling to 3.7% as late as October, it’s still double the Federal Reserves target of 2%. It’s also important to remember that the monthly inflation rate readings are cumulative. Though the price rise is slowing, prices are still up more than double digits since the trend began in 2021.

The Consumer Price Index is the most common measure of inflation and is determined by adding up the costs of a typical “basket” of goods and services that individuals by or use. It includes cost of food, transportation, housing, entertainment, medical care and many others. The government surveys the prices of several hundred items in over 200 categories as part of the calculation.

While the overall inflation rate has been low for the past decade, there have been certain segments of the economy where prices have increased steadily and sometimes dramatically. Medical costs have been rising at a double-digit rate and college costs have been increasing at a rate about double the overall rate of inflation.

Why is inflation important?

You must take inflation into account when planning for future expenses, particularly for retirement. Maintaining the financial lifestyle you desire in your retirement years is dependent on how much you have accumulated by the time you retire and how fast you spend those funds during retirement.

Inflation can also affect your investments. Generally, higher inflation or the expectation of higher inflation often leads to higher interest rates (lower bond values) and weaker stock prices. When consumers expect things to cost more in the future, they often put less “value” on their financial assets and the prices of those financial assets fall.

What should you do?

First, pay attention to the long-term rate of inflation. Inflation cycles tend to be relatively long-term, so if there are a series of monthly inflation rates above the recent 2% to 3% level, it could be an indicator of worse things to come.

Second, be sure to consider inflation in your investment planning, especially with respect to your fixed income investments. With interest rates at low levels, it may be advisable to consider shorter or intermediate term bonds (and bond mutual funds) for the fixed income part of your portfolio, even if you have to accept a lower current return. That way, if the inflation rate increases and bond values drop, owning shorter-term bonds will moderate the drop in bond values.

Third, factor a “realistic” inflation expectation into your financial planning. It is probably foolish to expect your cost of living to increase at the recent 2% to 3% level throughout your retirement years. The inflation rate is probably more likely to rise over the next several decades than it is to fall. In addition, some of your costs, such as health care, will increase as you age.

Inflation is one of the financial facts of life. We cannot control it and we do not know what it will be in the future. However, you should be mindful of inflation trends, factor a realistic expectation into your thinking and take steps to protect your finances just in case the inflation rate rises.