Mistake to Avoid – Delaying Saving for a College Education

Starting to save for college early is crucial due to rising costs. For example, saving for a 7-year-old's college fund is more manageable than waiting.

Being able to afford to send your children to the colleges of their choice, without being limited by cost, can be one of the great joys of being a parent.

But, attending college is expensive. According to a study from the College Board (Trends in College Pricing 2018), the average total cost for a year (tuition, books, fees, room, board, transportation, and other expenses) was over $28,000 at public universities for in-state students, and over $60,000 at private colleges. And costs continue to rise.

Over the past decade, the costs of getting a college degree have gone up about 6% per year on average. If this trend continues, and all indications are that it will, the cost for a year of college will double in 12 years and triple in 19 years. And remember, increasing numbers of students are spending more than four years in college.

One of the keys to accumulating the money needed to send your child to college is to start saving early. Let us use an example of a seven year old (11 years until college) that will attend a state university as an in-state student. The estimated total current cost of a year at that university today is about $25,000. Assuming that costs increase 6% annually, her first year will cost about $47,000. If her parents want to have saved all of her college costs by the time she begins, they need to have accumulated over $207,000 by then.

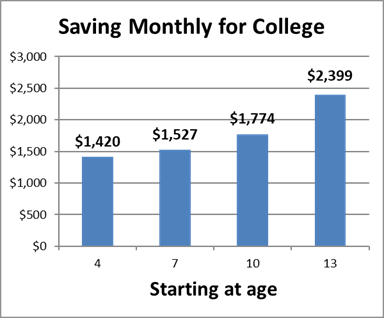

Let us assume her funds earn 5%. If her parents had started at age four, they would have needed to save about $1,420 per month. If they start now when their daughter is seven years old, their monthly savings need to be $1,527. If they wait until she is 10, they will need to save $1,774 per month. If they wait until she is 13, they will need to save over $2,399 per month. Starting to save early not only enables you to spread your saving over a longer period, but you also get he benefit of the earnings on the funds for a longer period of time.

Starting to save for that college education as early as possible makes a big difference. And the decision of when to start is up to you.